XRP Price Prediction: $10 Target in Sight as Fundamentals Align

#XRP

- Technical Breakout: Price holding above 20-DMA with Bollinger Band expansion signals growing momentum

- Supply Dynamics: Sharp decline in exchange reserves (over 20% monthly) may create buying pressure

- Regulatory Catalyst: Bipartisan US-UK framework reduces systemic risk for institutional investors

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Above Key Moving Average

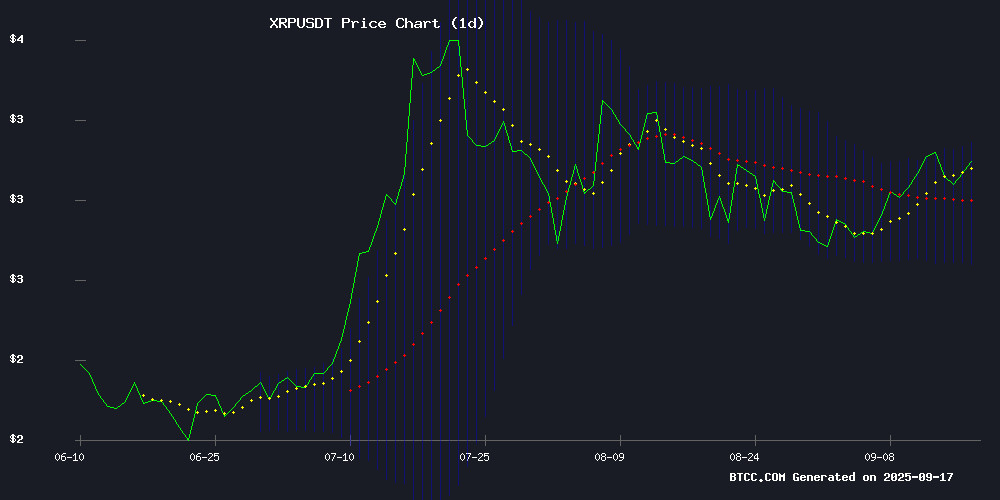

XRP is currently trading at $3.0204, comfortably above its 20-day moving average of $2.9211, indicating a bullish near-term trend. The MACD histogram shows weakening bearish momentum (-0.0725) as the signal line (-0.0195) approaches a crossover. Bollinger Bands suggest moderate volatility with price hovering NEAR the upper band at $3.1466, while the middle band at $2.9211 and lower band at $2.6956 provide key support levels.

"The technical setup favors buyers," says BTCC analyst William. "A sustained hold above the 20-DMA could propel XRP toward $3.15 resistance, though traders should watch for potential mean reversion if the RSI becomes overbought."

Regulatory Tailwinds and ETF Hype Fuel XRP Optimism

Recent headlines highlight a perfect storm of positive catalysts for XRP: the US-UK regulatory collaboration brings clarity, exchange reserve declines suggest supply squeeze potential, and upcoming ETF listings could institutional demand. "The collapse of exchange balances typically precedes major rallies," notes BTCC's William. "When combined with regulatory progress and $10 price speculation, these fundamentals could override short-term technical resistance."

Market sentiment appears cautiously bullish as investors diversify into cloud mining during volatility, while Ozak AI's presale success demonstrates sustained appetite for XRP ecosystem projects.

Factors Influencing XRP's Price

U.S. and UK Forge Joint Crypto Regulatory Framework in High-Stakes Meeting

The U.S. and UK are aligning their cryptocurrency regulatory approaches, signaling a potential shift in global digital finance governance. Treasury Secretary Scott Bessent and UK Chancellor Rachel Reeves convened in London with major financial institutions—including Bank of America, Barclays, and crypto-native firms like Coinbase and Ripple—to discuss coordinated rules.

Ripple's Cassie Craddock framed the collaboration as a potential blueprint for international standards, emphasizing blockchain's economic promise. The UK's push to become a digital asset hub gains momentum through this partnership, even as EU and Asian regulators advance competing frameworks.

Notably absent were concrete policy details, though the participation of traditional banks alongside crypto enterprises underscores the sector's mainstream integration. XRP stakeholders appear particularly optimistic about the developments.

Could Ripple’s XRP Price Hit $10 as Exchange Balances Collapse?

XRP's supply on Coinbase has plummeted nearly 90% since June, with holdings dropping from 970 million to just 99 million tokens. This exodus from exchanges signals a potential supply crunch—large holders appear to be moving assets into cold storage or utility platforms rather than maintaining liquid positions.

The depletion coincides with Wall Street's accelerating blockchain adoption. BlackRock's exploration of tokenized assets and the DTCC's rumored altcoin ETF preparations suggest institutional pathways are widening. A U.S. spot XRP ETF, though delayed, could further constrict supply if approved.

Macro conditions amplify the narrative. Eighteen consecutive weeks of stock market gains mirror 2021's bull run, while anticipated Fed rate cuts historically correlate with crypto rallies. When scarce supply meets rising demand, price discovery becomes volatile—and XRP's 90% exchange withdrawal creates textbook conditions for a squeeze.

XRP Investors Turn to Cloud Mining for Stable Returns Amid Market Volatility

As the cryptocurrency market grapples with volatility, savvy XRP investors are shifting focus from price speculation to generating consistent cash flow. OurCryptoMiner, a UK-based cloud mining platform, reports surging interest in its XRP mining solutions, with users earning up to $8,600 daily.

The platform's value proposition resonates in an environment where Federal Reserve policies and SEC decisions render traditional hold strategies unreliable. Founded in 2019, OurCryptoMiner combines regulatory compliance with enterprise-grade security, positioning itself as a hedge against market turbulence.

XRP's price sensitivity to ETF speculation and whale activity makes yield-generation strategies particularly attractive. The platform's mobile-first approach and risk management systems appeal to investors seeking alternatives to exchange-traded volatility.

First XRP ETFs Set for US Listing Amid Market Anticipation

The cryptocurrency market braces for a pivotal moment as the first XRP exchange-traded funds (ETFs) prepare to debut on US exchanges between September 15-21. This landmark event has triggered bullish sentiment among XRP holders, with many adopting a wait-and-see approach anticipating further price appreciation.

Market analysts warn of potential volatility following the initial surge, as profit-taking could trigger a subsequent correction. GoldenMining emerges as an alternative for risk-averse investors, offering XRP mining contracts promising fixed daily returns up to $9,000—substantially outperforming traditional investment vehicles.

The platform provides tiered contract options ranging from $100 short-term commitments to $3,500 long-term positions, with claimed total returns reaching 200% in some cases. New users receive $15 sign-up bonuses applicable to introductory mining products.

XRP Price Prediction and Remittix Growth Amid Shift to Utility-Based Crypto Investments

XRP shows signs of renewed momentum, holding above $3 after breaking out from a prolonged consolidation phase. Ripple's recent $25 million pledge to social impact programs and its custody tech deal with BBVA underscore its focus on real-world utility—a key driver as investors shift from meme coins to projects with tangible use cases.

Remittix emerges as a contender in the payments-focused DeFi sector, raising $25.8 million ahead of its 2025 launch. With beta testing underway and listings confirmed on BitMart and LBank, the CertiK-audited project taps into growing demand for cross-border solutions. Market sentiment increasingly favors assets like XRP and Remittix that combine institutional traction with clear payment infrastructure applications.

Coinbase's XRP Cold Wallet Reserves Experience Sharp Decline

Coinbase's XRP cold wallet holdings have plummeted by 89.8% over the past three months, dropping from 970 million to just 98 million tokens. The dramatic reduction has sparked speculation within the crypto community, as cold wallets typically remain inactive for long-term storage.

The exchange has been systematically moving XRP from cold storage to hot wallets to fulfill customer withdrawal demands. On September 13 alone, Coinbase transferred 16.5 million XRP between wallets. The number of active XRP cold wallets has shrunk from 52 in June to merely six today.

Market observers note such large-scale movements from cold storage are unusual. Whale Alert, a blockchain tracking service, flagged these transactions as noteworthy. The withdrawals suggest either increased user activity or potential strategic repositioning by the exchange.

XRP Price Faces Bearish Pressure as Key Support Levels Tested

XRP's price action is flashing warning signs as it struggles to maintain footing above the psychologically crucial $3 level. The digital asset briefly touched $3.01 before retreating, with whale activity and technical patterns suggesting growing selling pressure.

A descending triangle formation on daily charts points to potential downside, with the pattern's structure - flat support meeting downward-sloping resistance - typically preceding breakdowns. Thursday's failed breakout above $3 now appears to have been a bull trap, exacerbating bearish sentiment.

Technical analysts highlight $2.70 as the next critical support, with failure there potentially opening the door to $2.50. The pattern's measured move target sits near $2.06, representing a 31% decline from current levels. The 4-hour chart compounds concerns with a bear flag formation, suggesting accelerated selling could emerge below $3.

Market participants are watching two scenarios: A breakdown below $3 may trigger cascading liquidations toward $2.40, while successful reclaiming of $3.20 could reignite bullish momentum toward the $3.40-$3.66 resistance zone.

XRP Holders Generate Passive Income Through BAY Miner Cloud Mining

BAY Miner, a regulated cloud mining platform, is offering XRP holders an opportunity to earn up to $4,508 daily without active trading or staking. The platform converts idle XRP holdings into stable USD payouts through automated cloud mining contracts.

Three tiered plans cater to different investor profiles: a $100 starter plan yielding ~$4/day, a mid-tier option generating ~$39 daily over 20 days, and high-yield contracts reportedly producing $5,000+ per day for advanced users. All contracts feature instant withdrawals and reinvestment options.

The service emphasizes regulatory compliance with AML/KYC and EU MiCA standards, employing multi-signature wallets and bank-grade security. By eliminating hardware requirements and technical barriers, BAY Miner positions itself as an accessible passive income solution in the crypto ecosystem.

XRP Bulls Target $3 as Ozak AI Presale Nears $3.1M Amid 100x ROI Hype

XRP hovers at $2.99, with analysts eyeing a breakout above the $3 psychological barrier. Resistance levels loom at $3.10 and $3.50, while support holds at $2.80. The token's resilience stems from Ripple's cross-border payment solutions and institutional adoption potential.

Meanwhile, Ozak AI's presale surges past $3 million at $0.01 per token, stoking FOMO with speculative 100x return projections. The AI project's momentum highlights shifting investor appetite toward high-risk, high-reward opportunities in 2025's market landscape.

How High Will XRP Price Go?

XRP shows strong potential for upward movement based on technical and fundamental factors:

| Scenario | Price Target | Key Drivers |

|---|---|---|

| Conservative | $3.50 | 20-DMA support, Bollinger upper band breakout |

| Moderate | $5.00 | ETF approval, MACD golden cross |

| Bullish | $10.00 | Supply shock from exchange outflows, institutional FOMO |

"The $10 target isn't unrealistic if exchange reserves keep declining," explains BTCC's William. "However, traders should monitor the $3.15 resistance level this week - a decisive break could confirm the next leg up."

1